Get In Tune, Get In the Money.

How long has it been since you’ve heard the phrase “$100 oil”?

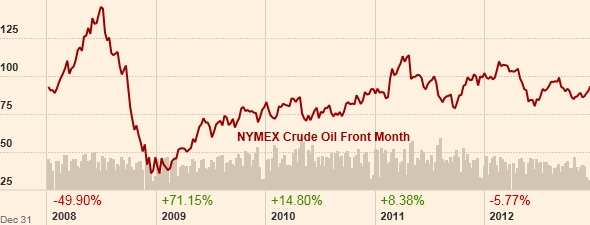

We’ve peaked that threshold only for brief periods over the past two years, but have come nowhere close to the $145 we saw in the summer of 2008.

I truly believe the only thing that kept oil from shooting through $150 then was a little thing called global economic recession. After hitting $145 in July 2008, we saw $31 oil in time for Christmas that year.

In the four years since, much has changed…

We’re undergoing U.S. shale revolution. There was an Arab Spring. We saw an extended Euro crisis.

And as all this has unfolded — some of it bullish for oil, some of it bearish — one thing has remained constant: Oil prices have steadily marched higher.

Get In Tune, Get In the Money

Since bottoming out in the low $30s, crude oil has turned in a constantly appreciative performance…

By summer 2009 we were back to $70. Summer 2010 saw $80. And by spring 2011 we were back over, if only temporarily, $100.

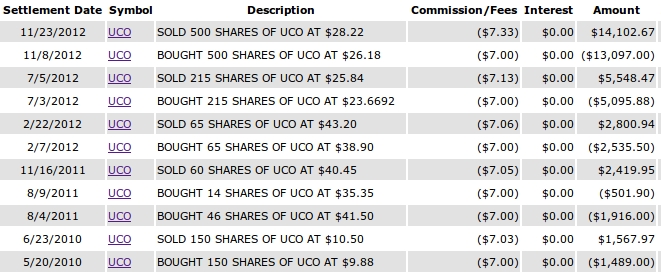

We’ve been see-sawing between $80 and $100 since then, which is why I’ve been advocating going long oil any time it breaks below $85. That’s most easily accomplished with the ProShares Crude Oil ETF (NYSE: UCO).

Since 2010, readers of mine have done that for profit nine times. Personally, I’ve done it five times. You can see that trade history below.

In that most recent November trade, I made over $1,000 in 15 days simply because I was in tune with the price of oil.

I’ve gotten pretty comfortable with this range. After all, it’s been exactly the same since late 2010. You could just rinse and repeat.

But now, I’m seeing something different…

The Return of $100 Oil

I’ve told you many times before, but it bears repeating: The world consumes more oil than it produces.

You can see it plain as day on the Energy Information Administration website. The most recent data available show the world produced 74.061 million barrels of oil per day; it consumed 87.616 million.

Some of the difference is made up with refinery gains and natural gas liquids. And this is why you sometimes see “Total Oil Production” along with “Crude Oil Production.” But even with the addition of those other liquids, global consumption is greater than production by some 531,000 barrels per day.

It’s this difference that keeps the pressure on oil prices. All things being equal, it’s this difference that allows me to get comfortable with a crude oil price range and trade it back and forth.

Now, for the first time in a few years, all things aren’t equal. The global economy is starting to improve. And that means the world is going to consume even more oil, widening the gap between demand and supply — and driving prices even higher…

Take a look at crude oil prices over the past five years:

There is a clear upward trajectory. And over the past year, the range has been getting more and more narrow.

A breakout is upon us.

And if oil prices have been slowly gaining steam for the past four years with tepid global recovery, where do you think they’ll head as the recovery pace quickens?

By 2020, the International Energy Agency says the world will need 99 million barrels per day.

The only problem with that? The world has NEVER produced more than 91 million barrels per day.

So we need to start producing at least 8 million more barrels of oil per day in the next few years, roughly the equivalent of what the U.S currently produces.

Because the world has never increased crude production this fast, I’m extremely bullish on crude oil and the companies that will be producing it.

During this “shale boom,” the world has added five million barrels per day of production. We’ll need another 1.6 shale booms to keep pace with demand over the next seven years.

And this is where we come back to one of the major tenets of Peak Oil: flow rates.

One or two or ten trillion barrels in the ground does us absolutely no good until it’s extracted.

Think about it this way…

I need you to fill up a five-gallon bucket of water. You have two methods of doing so: a hose and a block of ice.

Using the hose is easy and takes seconds. It turns on and off with ease. This is the light, sweet crude we’ve been producing for decades.

But this new oil we’re finding, while there is a lot of it, is much harder to get — like the block of ice. It takes a different technique, it takes much longer, and you can’t get as much as fast.

This is where the global oil market is now.

The spigots — Ghawar, Cantarell, Prudhoe Bay — have all peaked and are declining at 8%-10% per year. The remaining oil is more difficult and expensive to produce and refine.

It’s because of this reality that oil prices and oil stocks will rise rapidly as the global economy improves…

Call it like you see it,

Nick is the Founder and President of the Outsider Club, and the Investment Director of the thousands-strong stock advisory, Early Advantage. Co-author of two best-selling investment books, including Energy Investing for Dummies, his insights have been shared on news programs and in magazines and newspapers around the world. For more on Nick, take a look at his editor’s page.